Luxoft (LXFT)

Premier Software Developer with Cost-Effective Eastern European Talent – Long-Term Potential to Compound at 20%

Disclosure

We are long shares of Luxoft. Please click here to read full disclosures.

Kerrisdale Capital will host a conference call today at 11:00am EDT to discuss the Luxoft report.

To participate in the conference call, dial 888-567-1602 (US and Canada) or 862-255-5346 (international) and reference the Kerrisdale Capital call.

A replay will be available following the call at kerr.co/lxft-oct4.

We were impressed with the quality of Luxoft’s people. More than 70% of Luxoft employees are senior specialists with over 7 years of experience, and over 80% are educated to Master’s or Ph.D. level. At Luxoft we’ve found teams of experts ready to grill you with tough questions. And that’s what you need on complex projects.

– Daniel Marovitz, Former COO at DB’s global banking unit

We are long shares of Luxoft as we believe the company is poised to double revenue over the next five years, and then do so again over the subsequent five. Luxoft’s stock has declined in 2016 as investors have become concerned with slowing growth. The recent move by the U.K. to leave the European Union exacerbated the weakness as the European banks (including Deutsche Bank, Luxoft’s largest customer) are being pushed to multi-year lows. However, Luxoft remains a premium vendor whose services are mission critical for clients. The recent renewal of a five-year Master Services Agreement (MSA) with Deutsche Bank illustrates customers’ reliance on Luxoft despite a challenging market environment.

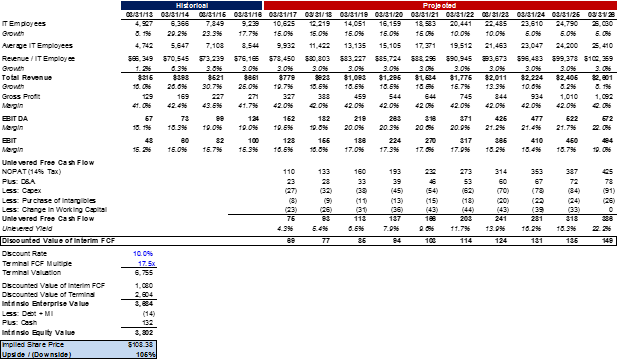

With a revenue base of over $680 million, Luxoft resembles Cognizant (CTSH) 10 years ago, highlighted by a comparable growth trajectory. Cognizant’s revenue exhibited a remarkable 37% CAGR over a 15-year period, developing from a modest $89 million in 1999 to a $10 billion offshore powerhouse. We think LXFT can grow at a similarly high rate over the next 10 years. Our view is underpinned by management’s recent guidance of 20% compounded revenue growth, $1.5 billion in revenue by FY 2020, and a resulting market capitalization of $3 billion within five years. In fact, we think that forecast is conservative. A more likely scenario: LXFT multiplies its revenue base by 4-5x supported by its position as a best-in-class provider of high-end software developers serving a massive total addressable market. Our DCF analysis suggests shares are worth ~$108 today (105% upside) and likely more in time.

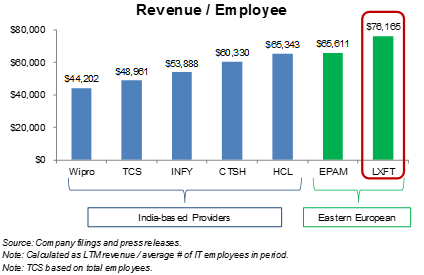

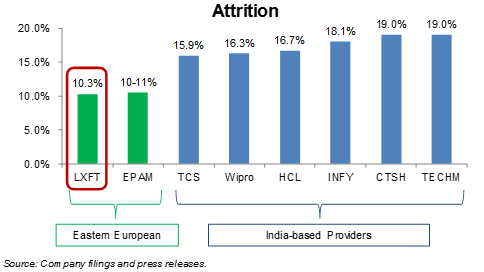

Luxoft’s differentiated focus on high-end software development is executed via engagement of leading programming talent in the science-centric Central and Eastern European (CEE) region. Unlike the large Indian vendors deriving value primarily from labor arbitrage, LXFT’s value proposition is predicated on an exceptionally skilled employee base to deliver sophisticated domain expertise. LXFT employs nearly 9,000 offshore programmers in the CEE geography, a region deeply rooted in science and technology; these emerging economies produce nearly one million engineering graduates annually. The company has already achieved success with this strategy, growing revenue at a 27% CAGR over the last five years while building out proficiency in sectors such as financial services and automotive. Furthermore, Luxoft commands a premium bill rate and generates the highest revenue per employee within the offshore industry. In an industry that competes aggressively for talent, LXFT boasts the lowest attrition rate among its peers.

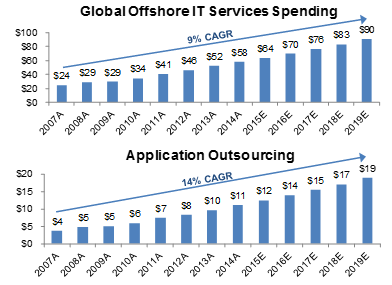

The offshore IT services industry is well-positioned to grow, fueled by a significant enduring cost differential between U.S. and non-U.S. IT employees. The current climate of hyper-paced digital advancements within every industry, coupled with a shortage of talent in the U.S., will result in continued outsourcing of labor to countries with a cheaper and more abundant workforce. While the total offshore IT industry is expected to grow at 9% through 2019, the application outsourcing sub-segment in which Luxoft operates is projected to grow at 14%. Luxoft’s ~9,000 IT employees represent a mere fraction of the hundreds of thousands employed by the Indian vendors, and its LTM revenue of $681 million is a tiny portion of a thriving $60 billion industry. If LXFT and its CEE peers attain a quarter of the success realized by their Indian counterparts in the late 90s and early 2000s, LXFT will not remain a $1.7bn, or even $10bn, company for much longer.

I. Investment Highlights

- Unique Central and Eastern European-based IT outsourcing firm focused exclusively on high-end software services. Luxoft has over 9,000 offshore computer programmers and serves clients primarily in North America and Western Europe. Relative to its peers in India, Luxoft does not compete on price, but on providing teams of programmers who understand clients’ businesses and industries intimately, and are capable of providing advanced, customized application development and other IT solutions. Rather than compete with Indian offshore providers that leverage labor arbitrage to undercut rivals, Luxoft focuses on high-end software services, hiring skilled engineers. Indian vendors oftentimes fill their ranks with novice developers, heavily recruiting recent college graduates; in contrast, 80% of Luxoft’s employees have a master’s degree and at least five years of professional experience. This approach has enabled Luxoft’s developers to command a premium bill rate relative to the prevailing industry standard, as well as cultivate a reputation for unrivalled quality of work.

|

LXFT Commands High Bill Rate |

|

- Significant growth opportunity supported by Luxoft’s focus on application services. While global offshore IT services are expected to grow 9% annually through 2019, Luxoft operates in the application outsourcing sub-segment which is projected to grow 14% annually over the same period. Growth of the offshore IT industry will be supported by the cost differential between U.S. and non-U.S. IT employees. Furthermore, as U.S. companies scramble to fill gaps in areas such as mobility, big data, analytics and automation, the dearth of engineering talent should only become more pronounced over the next decade.

|

Application Outsourcing Projected to Outgrow Overall IT Spending |

Source: IDC worldwide offshore IT services forecast. |

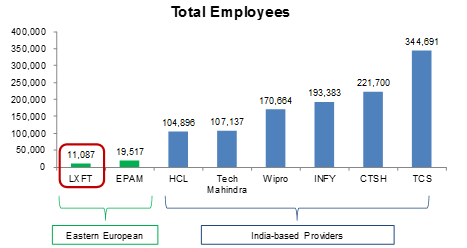

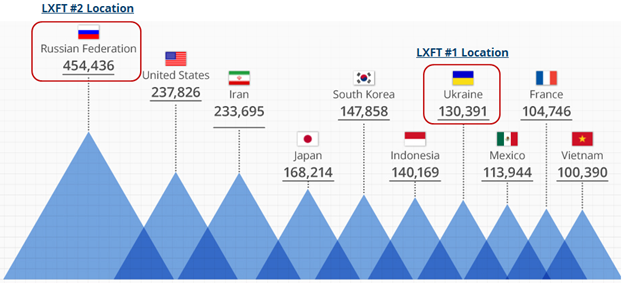

- 11,000 total firm headcount highlights LXFT’s relatively small position in the industry and potential growth opportunity. HCL Technologies (HCL), which is only the sixth largest Indian offshore player, boasts an employee base that is still 10x that of Luxoft. With $680 million in revenue, LXFT accounts for barely a sliver of a mammoth $60 billion industry. If Luxoft can multiply its headcount by ten and deploy those new programmers at similar margins, the company’s valuation could also easily multiply by a factor of ten. Given the abundance of high quality engineers available in the CEE region, Luxoft’s ability to source new talent shouldn’t be a formidable challenge. In the science-centric CEE geography, nearly 1 million students graduate annually with a degree in engineering. LXFT has a high concentration of employees in Russia and Ukraine, which together account for nearly 600k engineering graduates.

|

Headcount vs. Indian Players |

|

Source: Company filings and press releases. |

|

Countries with Most Engineering Graduates |

|

Source: World Economic Forum 2015 / UNESCO Institute for Statistics. Note: Excludes China and India. |

- Extremely compelling valuation vis-à-vis growth opportunity. For an emerging IT services player with a unique niche in the growing offshore IT services industry supported by a favorable demographic (i.e. high concentration of smart engineers in CEE), we think the current share price undervalues LXFT’s opportunity to multiply its revenue base by at least 4-5x over the next 10 years. We project that if LXFT’s IT employee base grows at only an 11% CAGR (identical to the overall offshore application outsourcing industry), LXFT’s revenue base would be 4x larger in 10 years. Our DCF suggests an intrinsic value of ~$108/share, implying 105% upside.

|

Discounted Cash Flow Analysis |

|

Source: Company filings and Kerrisdale analysis. |

- Attrition rate of 10.3% lowest in the industry. In the IT outsourcing industry, talent is amongst a company’s most valuable assets. As such, we consider employee attrition a key metric when analyzing the sector. Luxoft’s employee attrition is one of the lowest in the field, due partly to its mature and highly experienced workforce in addition to its comparatively high pay for the region.

|

Attrition Relative to Industry |

|

Source: Company filings and press releases. |

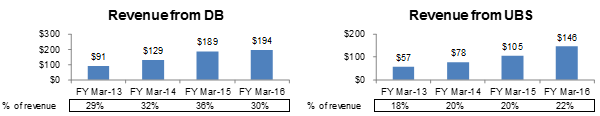

- Success with Deutsche Bank and UBS Demonstrates High Customer Value Proposition. Luxoft’s enormous success with marquee clients such as Deutsche Bank and UBS (its largest clients) is representative of the company’s ability to exponentially scale each new account. As a result of these long-term relationships (DB has been a customer since 2003, UBS since 2008) and focus on front-office assignments (revenues mostly generated in investment banking and wealth management), Luxoft has developed in-depth subject matter expertise in the financial services industry. Revenue from both clients nearly doubled in the two-year period between FY’13 and FY’15.

|

Revenue from DB and UBS |

|

Source: Company filings. |

Read our full report here.

Add New Comment