Korn Ferry (KFY)

Secular Transformation To Drive Re-Rating Amidst Cyclical Upturn

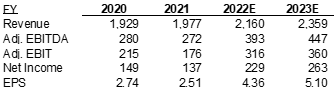

In the 18 months since our original report on Korn Ferry, available at kerr.co/kfy, we’ve gained further conviction that the company’s combination of strong revenue growth, attractive incremental margins, and higher subscription revenue mix will continue to drive estimates and multiples higher.

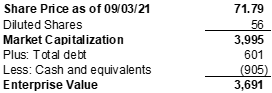

Korn Ferry is the dominant executive search firm and is successfully transforming into a digital-first global consulting organization with a leading technology platform. The company brings an increasingly diversified revenue mix that’s lowered cyclicality in the business, and a scale advantage that is not reflected in its current valuation when comparing KFY to its sub-scale private competitors or firms competing down-market. The company’s recent proxy suggests management wants us to comp the business to commercial real-estate companies like Jones Lang Lasalle Inc. and asset-light dominant franchises like Nielson Holdings plc, and we agree. Korn Ferry’s business model shares many similarities to the commercial real-estate market, including share gains in a fragmented market providing consolidation opportunities, with a growing demand for outsourcing of services benefiting large established incumbents with diversified business segments like KFY. We think shares re-rate from current 8.5x EV/EBITDA multiple to 12 -14x, driving upside for the stock to the $100 – 110 range.

Read our full update here.

Add New Comment